Customs Declaration Service Data (CDS) is the cornerstone of customs compliance, an electronic record of declarations made by a business and its brokers to HMRC. Formerly known as MSS data, it’s an invaluable resource that provides an overview of customs declaration information for auditing, but the data-heavy format is unwieldy and prohibitively time-consuming to use. For this reason, there is a very low take-up rate for CDS data with the vast majority of requests submitted only when notice has been given for HMRC audit. However, at this point, it’s often too late to take action. This is where CAT360 comes in.

Using CAT360 To Analyse Customs Data

At Barbourne Brook, we have been using CAT360 to analyse and interpret our consultancy clients’ CDS data for nearly two years, and now we are offering it as a stand–alone product for use by in-house customs teams.

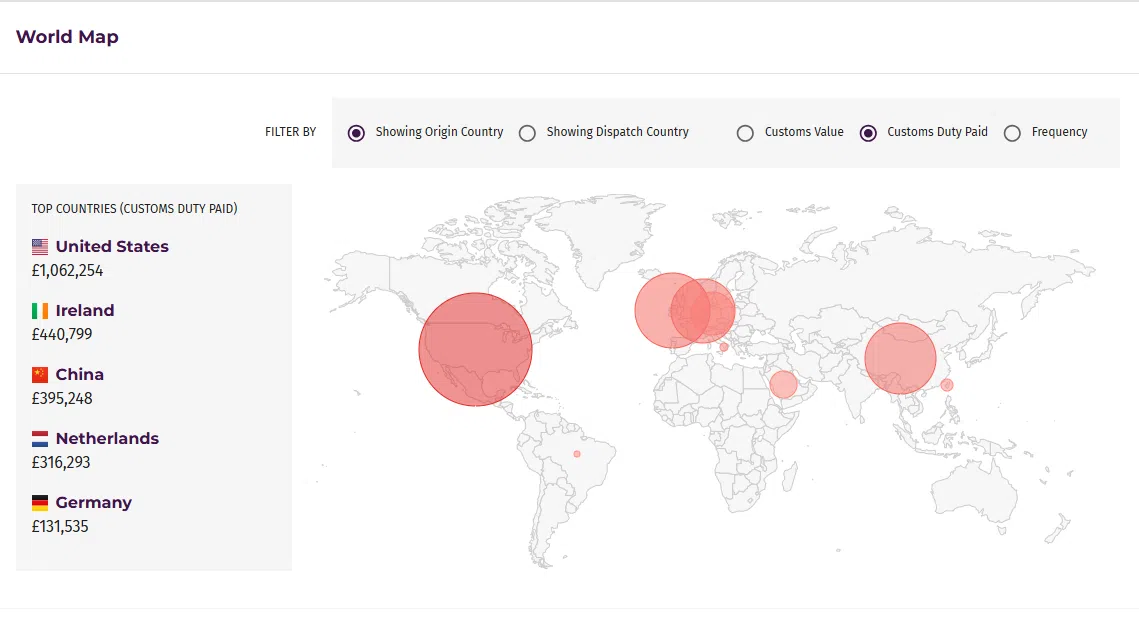

A simple interface feeds the CDS data into CAT360, and a series of algorithms extract insightful and actionable information. In a matter of minutes, CAT360 highlights errors and inconsistencies, indicating compliance issues and potential audit exposures, as well as reclaim opportunities. It works in a very similar way to the checks used by HMRC, so using it regularly can take all the stress and risk out of a possible audit.

In creating CAT360, we have drawn on our extensive industry experience. The product functionality enables businesses to:

- Immediately identify potential customs duty reclaims.

- Immediately identify opportunities to reduce duty spending and compliance risks.

- Gain clearer visibility for more informed decision-making.

- Pull reports for further analysis.

- Get a clear overview of your customs duty management and ensure ongoing compliance with minimal time input.

- Run similar checks to HMRC to ensure compliance.

Using CAT360 can minimise business risk by identifying errors and enabling them to be corrected proactively and without fines. It can also identify overpayments and give the information required to process a reclaim. It is incredibly efficient and eliminates the need to manually update spreadsheets with declaration information.

If this article raises important questions or cost-saving ideas for your business, reach out to Adam Wood today!

Related Posts

24 March 2025

Importers … Can You See What HMRC Sees? Unlocking Your Customs Data

Many businesses trust that their…

13 March 2025

Customs Compliance Gone Wrong – Key Lessons from a Tribunal

The QHH tribunal case centred around…

24 February 2025

Are Your Brokers Doing a Good Job? The Data May Surprise You!

34% of customs declarations contain…