Introducing Barbourne Brook’s Customs Analytics

Our Game Changing Software

Importers are solely liable for the accuracy of their customs declarations, even when outsourcing the completion and submission of entries to third parties.

This concept is known as Direct Representation, and every UK freight forwarder includes such terms in their contracts.

HMRC carries out some checks at the time of import, but customs compliance is primarily controlled by regulatory audit, with imports and exports remaining open for a minimum of three years.

Errors can lead to havoc within your business as well as reputational damage and loss of authorisations for duty relief.

Our Customs Analytics software bridges gaps when using third party customs brokers. Its checks can save your business time, effort, and money.

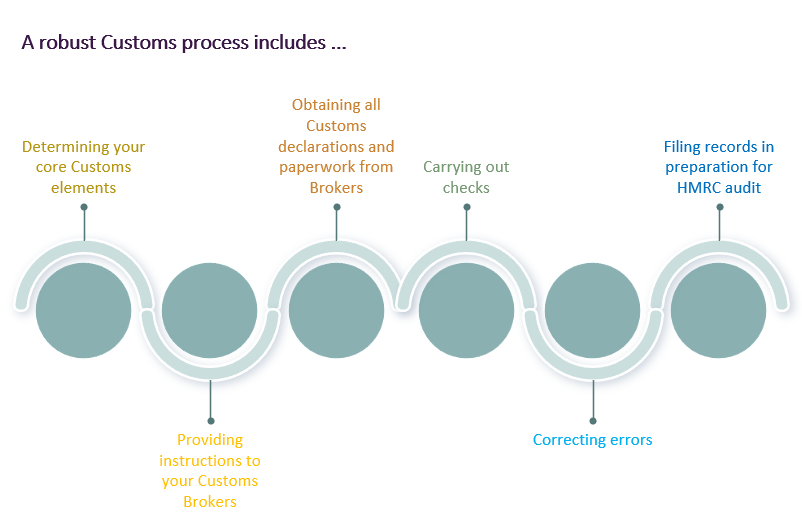

Missing Records

One of the key compliance challenges is obtaining copies of customs declarations from third party customs brokers. Most companies use several brokers, who in some instances delegate work to other brokers. Ask any shipping department and they will tell you how much time and effort is wasted chasing the paperwork. Failure to obtain your customs records leads you exposed to a breach of the Customs Traders (Records & Accounts) Regulations. It also evidences lack of control when HMRC carry out its audit.

Our Customs Analytics software includes obtaining data on all customs declarations made in your name, monthly, in electronic form.

The data can be used to:

- identify which records are missing;

- which party has failed to provide the records and their systems reference;

- supporting you in closing this compliance gap.

Carrying Out Checks

Companies should be carrying out checks to ensure the four following core elements of customs compliance are correctly entered by customs brokers:

- Customs Tariff Codes (also known as the commodity codes);

- Customs Origin and claims under Free Trade Agreements;

- Customs Value;

- Customs Procedure Code (CPC).

Our Customs Analytics software reports on these four elements in a business intuitive manner, supporting management by exception. Clients can go from carrying out small sample checks to completing checks in a fraction of the time.

Our software also includes several algorithms that carry out some common checks and report anomalies for further investigation.

Resolving Errors

If your company spots any compliance errors, these will lead to either:

- Overpayments of customs duty, which you will want to recover;

- Underpayments of duty. If you make voluntary disclosures before HMRC announce it is auditing, then your business will not be subject to penalties.

Businesses frequently go back to their customs brokers and instruct them to make the necessary corrections. This starts of cycle of instruction, chasing and amending or appending the original records. If you have subscribed to customs data, then this original data is now outdated and useless, making it difficult to manage compliance audits.

Our Customs Analytics software provides an auditable process for making reclaims or disclosures without the hassle of using several customs brokers.

Our solution also updates the original data once HMRC has accepted any corrections, keeping you in control.

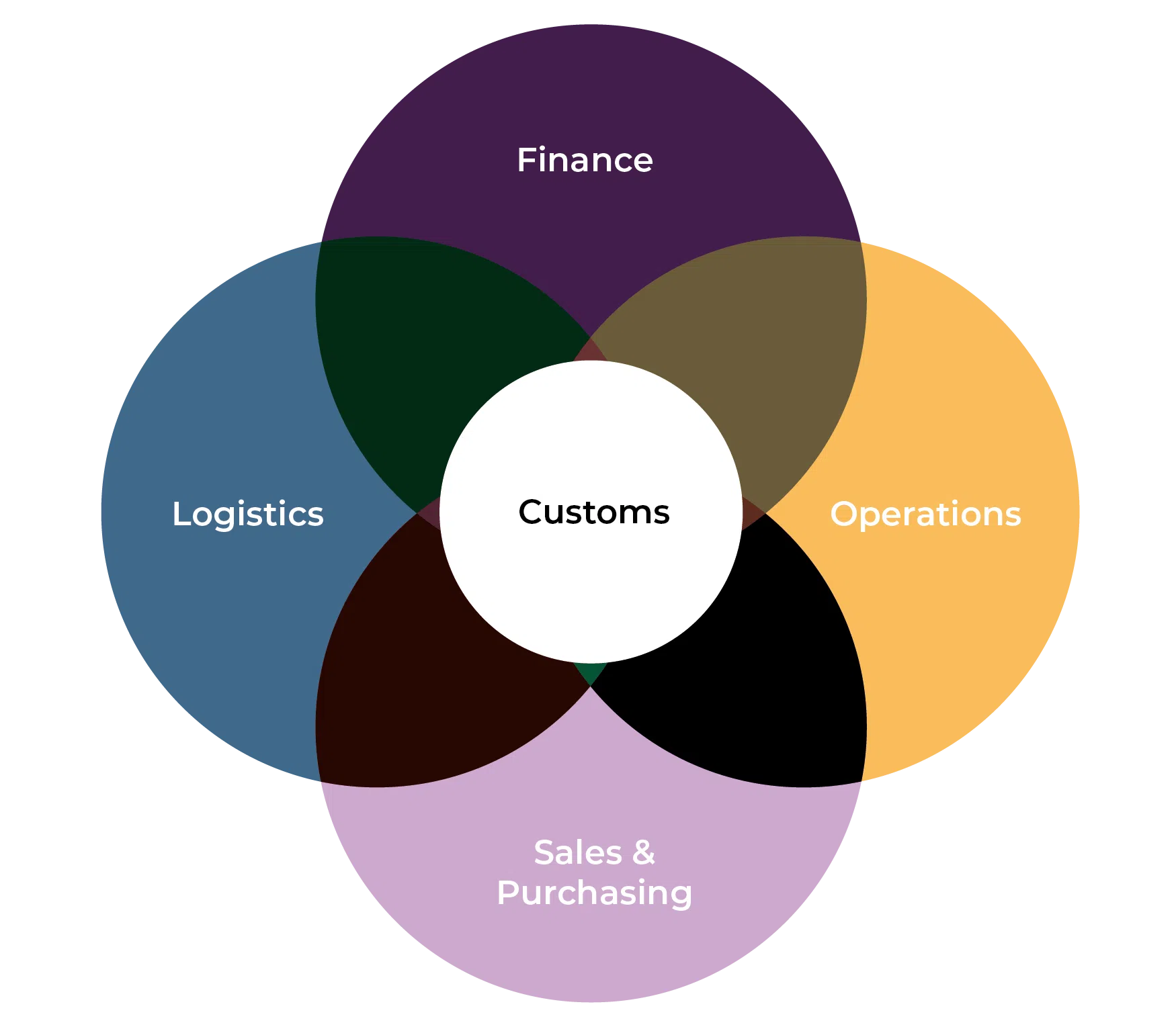

Communicating Across the Business

Procurement agrees the contractual terms with suppliers that impact on the classification, origin, and value of the imports.

Logistics controls the movement of goods to the UK and the customs broker relationship.

Warehousing carries out checks and spots discrepancies.

Finance manages the HMRC relationship. Sales agrees contractual terms with customers, including the shipping terms.

All stakeholders will want to extract management information to help them manage their part of the supply chain and relationships. The customs element is often invisible and hides costs and process failures.

Our Customs Analytics software provides automated reporting tools and dashboards putting all departments back in control. Company wide coherence also brings greater opportunities to utilise customs duty relief arrangements and improve gross profit margins.

Conclusion

Companies that fail to implement a robust customs process increase the risk of customs errors and the pains that flow from this. The materiality of non-compliance can snowball over a three-year period. Read our blog How to Develop a Coherent Customs Strategy.

Compliance and audit trails are difficult to manage because of the use of third parties and the data being external to your organisation.

Our Customs Analytics software bridges the gap when using third party customs brokers. Its checks save companies time, effort, and money.

Put your business back in control.

Related Posts

15 April 2025

Protected: Product Recalls and Customs Duty: Hidden Costs, Missed Opportunities

In the food and beverage sector,…

8 April 2025

The Hidden Customs Risks That Could Derail Your M&A Deal

Why overlooked customs operations can…

3 April 2025

Liberation Day Tariffs: What UK Businesses Need to Know

The reintroduction of sweeping US…