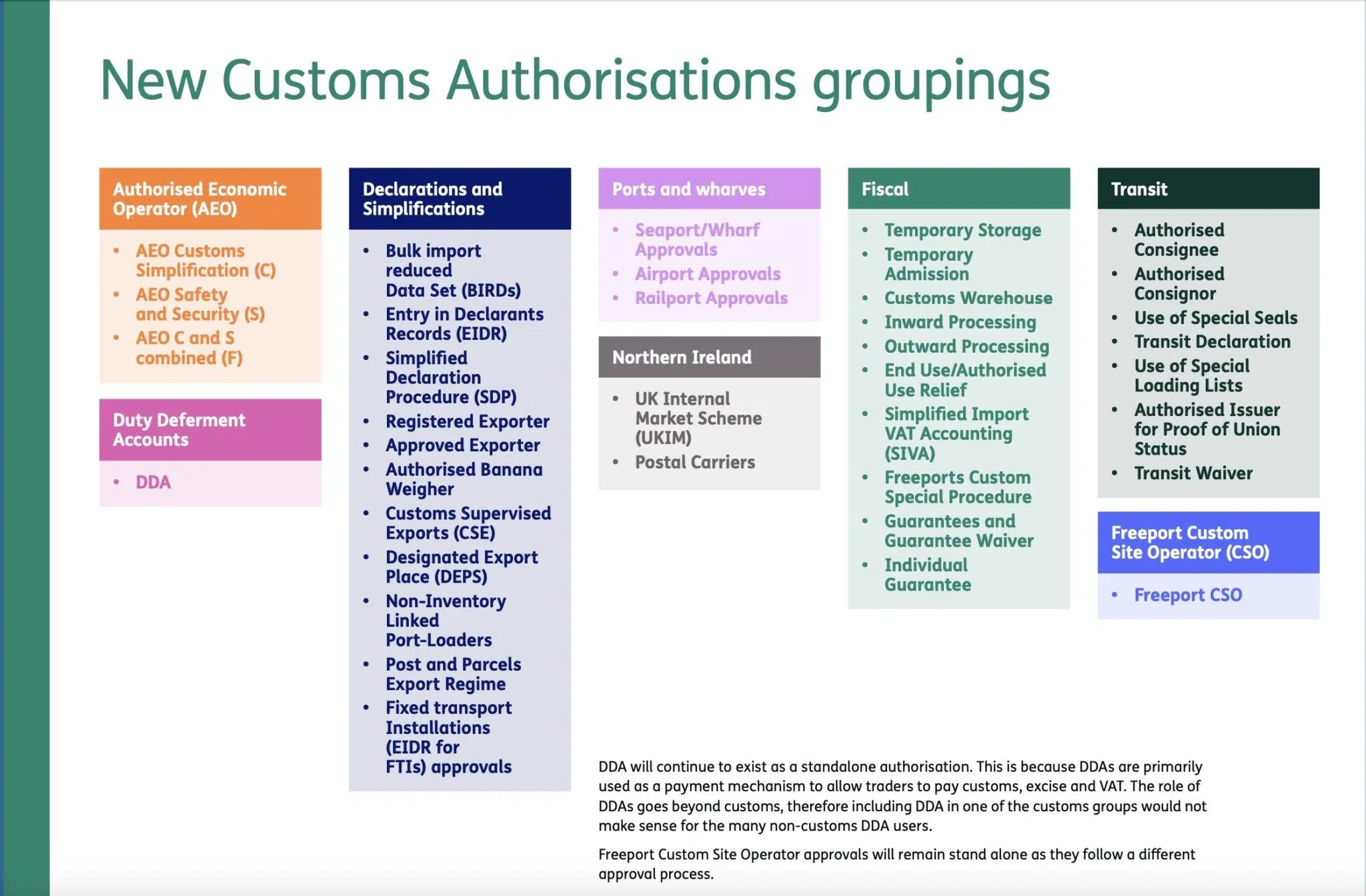

Later this month (currently scheduled for 30 September 2024), HMRC are due to introduce ‘Modernised Authorisations’ (MA), a digital portal intended to simplify, standardise and digitalise the customs authorisations process. The portal will essentially divide the 42 different kinds of customs procedures into five groups (see illustration), so there should be no need to repeat the company information required when applying for procedures from the same group. It should also see an improved application process, reducing admin and saving time.

There are minimal actions for businesses to take ahead of the introduction of this new portal. Current authorisations will remain active and will be migrated to the new system. HMRC advise that businesses should log in to the Gateway account and ensure details are correct to ensure easy access once the portal goes live.

Customs Consultancy Barbourne Brook suggests that, as good practice, businesses take this opportunity to review their current customs authorisations to ensure that all details are up-to-date and meet with the relevant legal obligations.

Adam Wood, Head of Commercial at Barbourne Brook comments:

“Most businesses take legal reporting responsibilities very seriously in relation to tax, but customs duty is often overlooked. Paper trails are frequently lost and authorisations may be out of date. This becomes a major issue if the business is selected for audit. The initial HMRC audit questionnaire will request paper trails for all existing authorisations and where these cannot be provided, the business is forced to declare that they have no record of whether or not they are compliant. This will inevitably trigger a deeper investigation, exposing them to risk of penalties, repayments and an ongoing administrative burden.”

Businesses should be able to answer the following questions in order to meet legal requirements and satisfy a HMRC audit questionnaire:

- What authorisations are in place?

- What are the details/conditions of the authorisations? Do you still meet them?

- Is there an end date to the authorisation? Is the authorisation still valid?

- Do authorisations still reflect the business model?

- What changes have been made to the authorisation since it was granted? Do you have an audit trail for those amendments?

For full information on HMRC’s “Modernising Authorisations” go to the Spring Budget 2023 customs package on GOV.UK.

If this article raises important questions or cost-saving ideas for your business, reach out to Adam Wood today!

Related Posts

24 March 2025

Importers … Can You See What HMRC Sees? Unlocking Your Customs Data

Many businesses trust that their…

13 March 2025

Customs Compliance Gone Wrong – Key Lessons from a Tribunal

The QHH tribunal case centred around…

24 February 2025

Are Your Brokers Doing a Good Job? The Data May Surprise You!

34% of customs declarations contain…